The SaaSpocalypse Was Predictable.

I’ve Been Warning You.

Wall Street just gave a name to what I’ve been shouting from rooftops: the SaaSpocalypse.

Traders at Jefferies are calling it “apocalypse for software-as-a-service stocks”—characterized by “get me out” style selling. ServiceNow is down 28% year-to-date. Salesforce has dropped nearly 26%. Intuit, the TurboTax parent, has collapsed more than 34%. The iShares Expanded Tech-Software Sector ETF just posted its worst month since October 2008.

Here’s the uncomfortable truth: this isn’t a panic. It’s a correction to reality.

I’ve spent the last year telling founders that SaaS is dead. Not dying—dead. The business model that defined enterprise software for two decades is fundamentally incompatible with what AI makes possible. And now Wall Street is finally catching up.

The Thesis Wall Street Finally Believes

Let me be clear about what I’ve been arguing:

Most SaaS software is just a bunch of tables with a relational element and CRUD operations. Create, Read, Update, Delete. That’s it. Most of these systems are glorified data archival—places where we input information to share and analyze with others. The actual work still happens in email, messaging, and spreadsheets.

Here’s the brutal question I ask every founder: What have you built that is technically very hard?

For most SaaS companies, the honest answer is: nothing. They’ve built interfaces on top of databases. And AI doesn’t need your interface.

The fear AI is bringing is increased competition, greater pricing pressure, and shallowing competitive moats. Jefferies’ traders put it starkly: “The draconian view is that software will be the next print media or department stores.”

Here are my previous posts on this topic:

Vibe Coding Changes Everything

This is what the market is pricing in: vibe coding.

Why would I pay for a SaaS platform that does 60% of what I need when I can build exactly what I need for a fraction of the cost? During a private equity conference last year, a CRM consultant was challenged on the future of his business. Two days later, he returned with a functioning CRM built using Replit—designed specifically for general contractors.

Twenty hours. Start to finish.

This isn’t hypothetical disruption. It’s already happening. Domain experts are using tools like ChatGPT, Replit, and Lovable to build real solutions without touching a line of code. As I’ve said: “You’re not a coder. You’re a subject matter expert. You can prompt these systems with no coding experience to build real tools that solve real problems.”

The AEC industry is filled with frustration over clunky, overpriced software. Now anyone with domain expertise can build something better, faster, and cheaper.

BIM Predicted This

I wrote a textbook on BIM for owners and developers in 2011. My belief was that Building Information Modeling would revolutionize how buildings were created and maintained. I was wrong.

BIM tools were marketed to architects and contractors, not owners. They became fancy drafting software—optimizing drawing production rather than delivering operational insights. Most owners still receive paper closeout documents, or at best a PDF. The promise of a dynamic, data-rich “as-built digital twin” never materialized.

Here’s what I learned: technology that adds overhead without delivering outcomes for the people who matter most is eventually rejected.

SaaS made the same mistake. Enterprise software optimized for seat licenses, not outcomes. It tracked activities rather than delivering results. And now AI is calling that bluff.

“AI doesn’t need a 3D model; it needs data. Owners need insights, not more geometry.” The same applies to SaaS: AI doesn’t need your interface; it needs your data.

The Real Shift: From Tools to Outcomes

What VCs are saying now is what I’ve been arguing for months: selling SaaS to customers for them to monetize the benefit is over. With AI, software should deliver outcomes. Your CRM shouldn’t manage leads—it should create qualified leads. Your project management tool shouldn’t track tasks—it should complete them.

Every dollar going to AI infrastructure, AI tooling, AI headcount—that’s a dollar NOT going to another Salesforce seat, another Workday module, another ServiceNow add-on.

The TAM is shifting. Instead of selling $5K in ARR to 50 engineers at a 100-person firm, AI-first companies are capturing the entire value of the outcome. The market size isn’t shrinking—it’s being redistributed to companies that deliver results rather than rent interfaces.

The Valuation Bloodbath: What This Means for Startup SaaS

Here’s where this gets personal for founders. Public market carnage doesn’t stay in public markets. It cascades.

The mechanics are brutal and simple: public and M&A markets drive liquidity to VCs. That liquidity allows them to raise new funds. Later-stage VCs are hyper-focused on short-term liquidity. Seed-stage firms depend on those later-stage VCs to fund growth. When the exit market freezes, the entire capital stack seizes up.

Right now, the Seed to Series A motion is clunky and brutal. It’s reflected in both appetite and valuations. And the data confirms the damage.

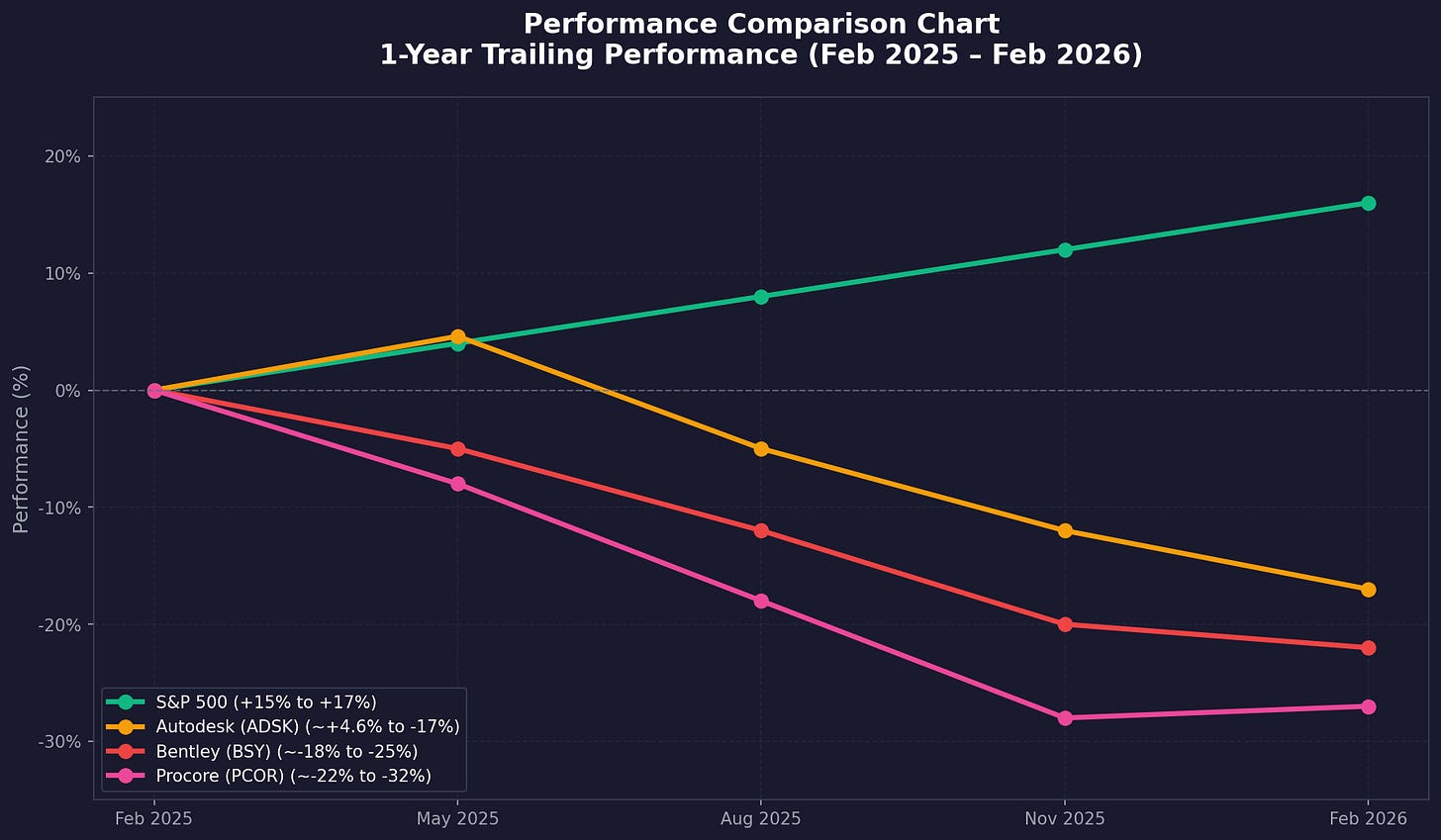

Private SaaS companies with ARR growth below 20% now command valuation multiples of just 3x to 5x ARR. Even moderate-growth companies achieving 20-40% ARR growth are seeing multiples between 5x to 7x ARR. Compare that to the 2021 frenzy when companies routinely commanded 15x-20x ARR regardless of fundamentals.

EBITDA multiples peaked at an extraordinary 39.9x in late 2022. The market has since shifted toward cash flow, margins, and operational efficiency. The “growth at all costs” playbook that defined a decade of SaaS is dead.

The two-tier market has arrived. The valuation gap between top-tier and mid-market software companies is widening. Profitable, recurring-revenue businesses in essential segments like cybersecurity and AI-enabling tools may see mild multiple expansion. Smaller or less differentiated vendors face stagnant or declining multiples as investors prioritize risk-adjusted returns.

What does this mean practically? The harder challenge lies with new software startups once destined for high-valuation IPOs. Here, consolidation looms. Private-equity funds are circling.

The Series A Cliff

I tell founders this constantly: you are more likely to sell to a PE firm than raise a monster Series A.

The capital doesn’t care about your 20% month-over-month growth anymore. They’re seeing AI-native companies doing 100% month-over-month growth. Cursor. Replit. The companies actually capturing the AI budget rather than losing budget to AI.

Here’s the paradox I’ve observed: it may actually be easier right now to raise money for a pre-revenue company than a post-revenue company.

Why? A revenue-focused company has proven or disproven market interest analytically. The numbers either support the thesis or they don’t. A product-focused startup is still hypothetical—still a story about potential. And in a market that punishes mediocre traction, stories about big futures often beat modest present realities.

The quality of revenue matters more than ever. Predictability of sales. Unit economics. Net revenue retention. Companies scoring above the Rule of 40 threshold—combining revenue growth rate with EBITDA margin—prove they can grow without sacrificing profitability. Those companies still command premium multiples. Everyone else is fighting for scraps.

The Investor Mindset Has Shifted Permanently

A company can post great quarterly results, raise guidance, even announce massive share buybacks, and still see its stock slide because the market is pricing in a future where AI changes everything. It’s not that the business is broken today; it’s that the narrative around its long-term moat feels shakier.

This is the core problem for SaaS founders: the narrative has broken.

For years, investors paid premium multiples for SaaS because of the moat story: switching costs, network effects, data gravity, integration complexity. Those moats are eroding in real-time as AI makes it trivial to replicate functionality and migrate data.

That shrinking P/E multiple reflects uncertainty, not disaster. When the future feels cloudier, investors demand a bigger discount. It’s classic risk-off behavior.

The challenge is figuring out where that multiple bottoms. And right now, nobody knows.

Rethink Your Capital Stack

Too many founders only understand venture capital. It may be that your startup isn’t a fit for VC anymore. The factory model of VC creates factory-model startups—everyone chasing the same format, not the right fit.

“Founders optimize for access to capital instead of optimizing for the customer. That’s the problem.”

Consider the alternatives:

Private Credit and Structured Finance. If you have predictable revenue and solid unit economics, debt might be cheaper and less dilutive than equity at current valuations.

Private Equity. PE funds are circling distressed SaaS companies. If you’re not growing fast enough for VC but have solid fundamentals, a PE exit might be your best path to liquidity.

Strategic Acquisition. Larger companies are using M&A to acquire AI capabilities and customer bases. If you can’t beat AI disruption, maybe you can be acquired by someone who can integrate you into a larger platform play.

Bootstrap to Profitability. The $500K ARR business with a $5M exit may not grab headlines, but it transforms lives—especially when the cap table is clean.

What Survives the SaaSpocalypse

Building hard things is hard. If you’re a SaaS founder reading this, here’s my advice:

Push your CTO to build defensible technology. Beyond CRUD and AI wrappers. What do you have that can’t be replicated by a domain expert with a weekend and Cursor?

Rethink your business model. During the dot-com era, I saw e-toys, e-pets—all e-commerce. Now it’s just commerce. If you’re building “AI for MEP Engineering,” consider dropping the AI prefix and just build an MEP Engineering business. Deliver outcomes, not tools.

Rethink your capital stack. Too many founders only understand venture capital. Your startup might not fit the VC model anymore. There are other paths to building meaningful, profitable businesses.

Ask yourself the hard questions: Could your clients vibe-code your product? Have you tried to vibe-code your own product? Which companies could build your product and beat you?

The Opportunity in the Wreckage

“That the pendulum has swung so far to the sell-everything side suggests there will be super-attractive opportunities that come out of this.”

The traders are right about one thing: when fear is this extreme, opportunity exists. Panic tends to punish indiscriminately at first, then the market starts sorting winners from losers more rationally.

But the opportunity isn’t in buying beaten-down SaaS stocks hoping for a bounce.

The opportunity is in building what comes next.

AI startups are being valued at 20x-30x revenue multiples, with exceptional cases exceeding 100x. Late-stage rounds show median revenue multiples climbing to roughly 25.8x, confirming a persistent premium for AI compared to traditional SaaS.

The capital is flowing. It’s just flowing to a different category.

AI doesn’t need your rigid platform. It needs data, domain expertise, and outcomes. The companies that capture AI budgets rather than lose their budgets to AI will define the next era.

The SaaSpocalypse isn’t the end. It’s the clearing of dead wood so something new can grow.

The Hardtech Investment Thesis for Construction

DCVC invests in AI-powered infrastructure and deep tech, including robotics companies using machine learning for real-world applications. They backed Agility Robotics for humanoid robots in logistics, Nuro for autonomous delivery, and multiple agricultural startups. OpenVC

The thesis emerging among sophisticated hardtech investors applies perfectly to the built environment:

Physical AI over software AI. R7 Partners operates on the thesis that “intelligence is coming into the physical world” through AI and robotics applied to atoms rather than bits, backing capex-heavy, long-horizon bets that many traditional early-stage funds avoid. VC Sheet

This is exactly what construction needs. Not another project management dashboard. Not another field reporting app. Companies that actually move dirt, pour concrete, fabricate components, and install systems—enhanced by AI.

Tech-enabled services over pure SaaS. I’ve been tracking a fundamental shift: construction tech startups moving from pure-play SaaS to tech-enabled service models. This used to be a no-no in VC. With AI, these tech-enabled businesses are able to deliver venture metrics of growth and gross margins. It’s pretty exciting.

Why? Because in construction, “It’s much, much easier to say yes to a service than it is to accept all of the overhead that comes with adopting a new tool. Beyond purchasing the tool, there are internal processes, IT approvals, and higher-ups to convince.”

Technology that delivers outcomes without requiring customer behavior change wins in the built environment.

Vertical integration over horizontal platforms. The future of construction firms looks radically different. Imagine a true construction firm—one entity that seamlessly integrates architecture, engineering, and construction, fully digitally enabled, learning from every project to continuously improve. A client could go to a single firm and say, “I want a bridge. I want a tunnel.” And get it delivered.

The firms embracing AI and automation will outperform. At a certain point, the efficiency gap becomes too big to ignore.